Simple Rules to Deal with the Ever-Changing World as an Investor - Seedly PFF 2023

- sawillard20

- Apr 16, 2023

- 2 min read

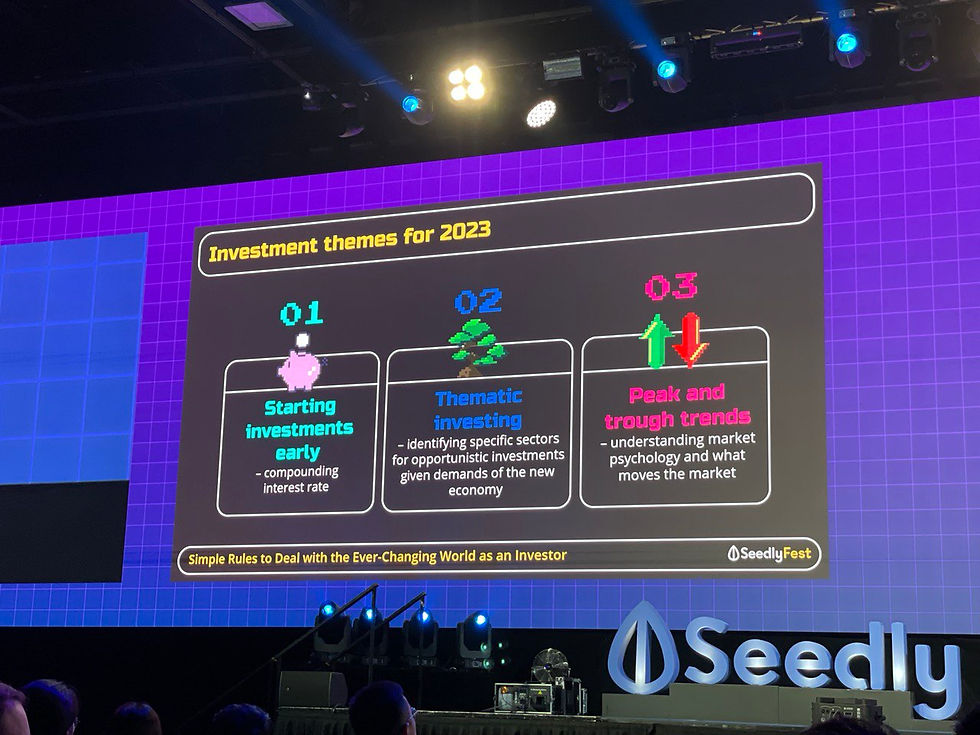

Investing in the ever-changing world seemed daunting, with global events, geopolitical tensions, and economic uncertainties constantly shaping the investment landscape. However, there are simple rules that investors could follow to navigate these challenges and build a successful investment strategy. Christopher Forbes, Head of CMC Invest Singapore, shared his insights on key investment themes and strategies for 2023.

Forbes advised starting investments early and staying consistent with regular contributions as one of the most powerful tools in investing is compounding interest. For example, investing $1000 initially and adding $50 every month could accumulate into a significant sum over time. Starting young allows for more time for investments to grow and compound, maximizing the potential returns. Forbes recommended investing in a low-cost, diversified index fund such as the S&P 500, which offered broad exposure to the U.S. stock market and had historically shown strong long-term performance.

Identifying macro-level trends or themes disrupting the global economy could provide significant investment opportunities, Forbes likened thematic investing to placing items in a Fridge - the ones who made money were those who supplied items like Coca Cola. He highlighted thematic investment opportunities in sectors such as renewable energy, electric vehicles, circular economy products, semiconductors, artificial intelligence, and big data. These sectors were expected to benefit from long-term, structural shifts towards net-zero emissions and sustainable practices. Investing in real-world change could not only provide potential returns but also contribute to a more sustainable future.

Geopolitical tensions and global events could impact retail investment strategies and Forbes suggested diversifying portfolios across different asset classes to manage risks. Different asset classes reacted differently to various geopolitical situations, so diversification could help mitigate risks and minimize portfolio volatility. Forbes recommended considering commodities like gold as a hedge against inflation, commodity funds or ETFs with careful examination of their holdings, and ESG (Environmental, Social, Governance) funds that integrated sustainability factors into the investment process. These strategies could help investors guard against uncertainty and manage risks in their portfolio.

Forbes emphasized the importance of adopting a long-term time horizon and staying focused on the investment objectives for strategic management in long-term investing. While short-term market fluctuations and events may tempt investors to make impulsive decisions, Forbes advised against trying to time the market. Instead, he suggested strategically managing investments by staying diversified, focusing on long-term trends and themes, and avoiding knee-jerk reactions to market volatility. He cautioned against doubling down on portfolios based on short-term market movements and encouraged investors to stay disciplined and focused on their long-term investment goals.

In conclusion, in the ever-changing world of investing, it is important to have a clear strategy and stick to simple rules. Forbes highlighted the power of compounding interest by starting investments early and staying consistent. Thematic investing for real-world change will provide significant opportunities in sectors with long-term growth prospects. Diversification across different asset classes will help guard against uncertainty and minimize portfolio volatility. Strategic management with a long-term time horizon will help investors stay focused on their investment objectives. By following these simple rules, investors could navigate the ever-changing world and build a successful investment strategy for 2023 and beyond.

Comments